How Amur Capital Management Corporation can Save You Time, Stress, and Money.

Unknown Facts About Amur Capital Management Corporation

Table of ContentsHow Amur Capital Management Corporation can Save You Time, Stress, and Money.All about Amur Capital Management CorporationLittle Known Facts About Amur Capital Management Corporation.A Biased View of Amur Capital Management CorporationThe Definitive Guide to Amur Capital Management CorporationSome Of Amur Capital Management Corporation

Not only will the home increase in worth the longer you have it, but rental prices typically follow a higher pattern. This makes real estate a profitable lasting financial investment. Property investing is not the only method to invest. There are lots of other financial investment choices readily available, and each features its very own collection of staminas and weaknesses.

Some Known Details About Amur Capital Management Corporation

Wise investors may be compensated in the type of recognition and dividends. As a matter of fact, given that 1945, the average large stock has returned near to 10 percent a year. Supplies actually can function as a long-term savings car. That stated, stocks might just as quickly drop. They are by no suggests a sure thing.

Nonetheless, it is simply that: playing a video game. The securities market is as much out of your control as anything can be. If you buy supplies, you will certainly go to the mercy of a relatively volatile market. That said, realty is the polar contrary pertaining to specific elements. Net earnings in realty are reflective of your very own activities.

Any kind of money gained or shed is a straight result of what you do. Supplies and bonds, while often abided with each other, are fundamentally various from each other. Unlike stocks, bonds are not rep of a stake in a business. Therefore, the return on a bond is dealt with and does not have the chance to appreciate.

Amur Capital Management Corporation for Beginners

The actual advantage real estate holds over bonds is the time framework for holding the financial investments and the price of return throughout that time. Bonds pay a set price of passion over the life of the financial investment, hence purchasing power with that interest drops with inflation over time (investing for beginners in canada). Rental building, on the various other hand, can create greater rental fees in durations of greater inflation

It is as easy as that. There will always be a need for the rare-earth element, as "Half of the world's population relies on gold," according to Chris Hyzy, primary financial investment policeman at U.S. Trust, the private wide range monitoring arm of Financial institution of America in New York. According to the Globe Gold Council, need softened in 2015.

The Buzz on Amur Capital Management Corporation

As a result, gold rates ought to come back down-to-earth. This must attract developers seeking to take advantage of the ground degree. Acknowledged as a reasonably risk-free commodity, gold has established itself as a vehicle to boost investment returns. Nonetheless, some don't even take into consideration gold to be an investment in all, rather a bush versus inflation.

Certainly, as risk-free as gold might be considered, it still fails to stay as attractive like this as genuine estate. Below are a couple of reasons investors choose property over gold: Unlike actual estate, there is no funding and, as a result, no area to utilize for growth. Unlike property, gold proposes no tax advantages.

Some Ideas on Amur Capital Management Corporation You Need To Know

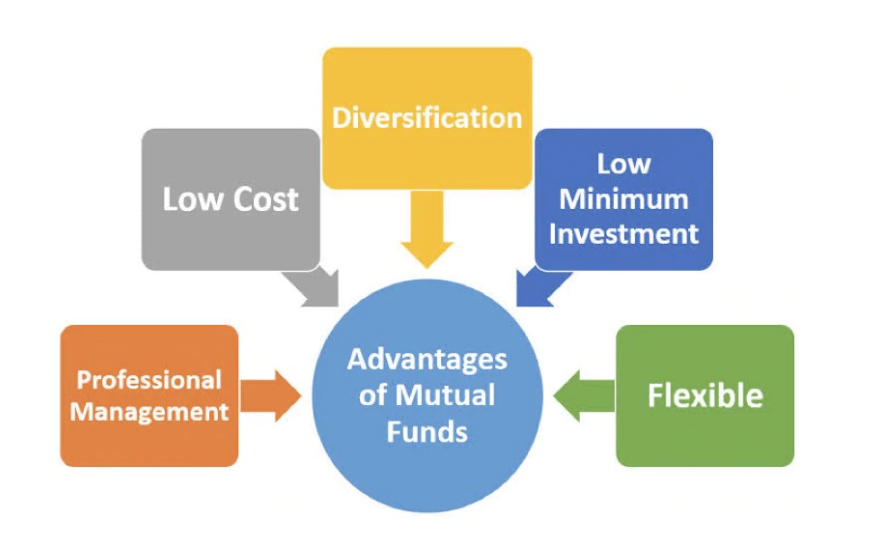

When the CD grows, you can gather the original investment, along with some interest. Certifications of down payment do not appreciate, and they've had a historical ordinary return of 2.84 percent in the last eleven years. Actual estate, on the other hand, can appreciate. As their names recommend, shared funds consist of finances that have actually been pooled together (best investments in canada).

It is one of the most convenient ways to branch out any kind of portfolio. A common fund's performance is always gauged in terms of overall return, or the amount of the change in a fund's web property value (NAV), its returns, and its resources gains distributions over an offered period of time. Nevertheless, a lot like stocks, you have little control over the performance of your properties. https://amur-capital-management-corporation.webflow.io/.

Positioning cash into a shared fund is basically handing one's investment decisions over to a specialist cash manager. While you can choose and pick your financial investments, you have little claim over how they do. The 3 most usual ways to buy realty are as adheres to: Get And Hold Rehabilitation Wholesale With the most awful part of the economic crisis behind us, markets have undergone historic gratitude rates in the last 3 years.

The Definitive Guide to Amur Capital Management Corporation

Acquiring reduced does not imply what it utilized to, and investors have identified that the landscape is transforming. The spreads that dealers and rehabbers have become accustomed to are beginning to summon memories of 2006 when values were historically high (capital management). Certainly, there are still many chances to be had in the world of turning genuine estate, but a brand-new departure strategy has actually emerged as king: rental homes

Otherwise referred to as buy and hold residential properties, these homes feed off today's gratitude rates and maximize the truth that homes are extra costly than they were just a couple of short years earlier. The concept of a buy and hold leave technique is straightforward: Financiers will seek to enhance their bottom line by renting out the property out and accumulating monthly cash money flow or just holding the residential or commercial property till it can be sold at a later day for a profit, obviously.